Blogs

Even if coming season obligations could be highest on account of which have an excellent lower level of extra depreciation to help you claim, it may also manage an online organization loss which can be folded more than and you will transmitted so you can upcoming many years. There can be things that make far more experience to decide away of your program; for more information, speak to your mentor to see if or not your qualify for extra decline and you may if this strategically is sensible so you can claim. Design is considered to start whenever physical functions out of a critical characteristics starts. Bodily works does not include first points including planning, designing, protecting financing, investigating, or search.

- The fresh asset’s base isn’t thought within the regard to a foundation obtained away from a good decedent.

- We away from pros is ready to make it easier to browse such intricacies and you may optimize your income tax benefits.

- When simulating the new funds and monetary effects of completely incentive decline, the brand new capture-up price to your low-corporate field is derived playing with research from the Treasury Agency and you may try calibrated up against the study based on the corporate tax model.

- Expensing happens in the future less than such issues as the an excellent taxpayer you to definitely usesCode Sec. 179expensing tends to make an annual election to do so for the a property-by-possessions foundation and determine the newest select-to possess element of a house’s cost.

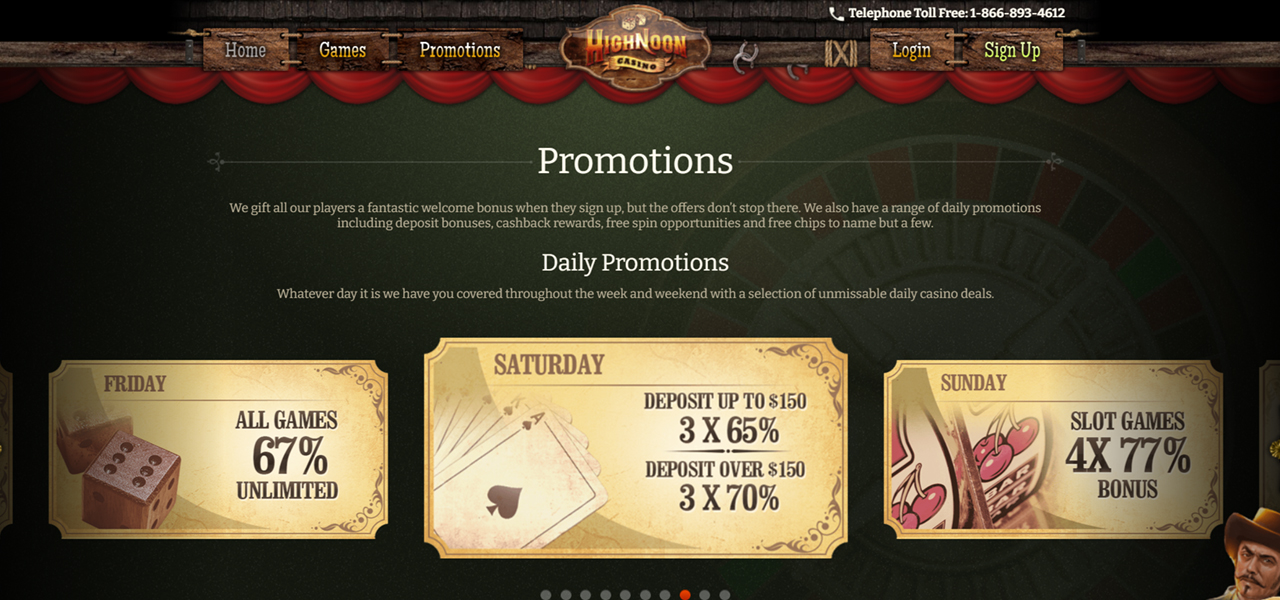

Within advice, MGM Benefits and you will Caesars Advantages will be the a couple finest support applications, as you accumulate points each time you play slots, not just in case your to experience form of games. As a result for those who don’t have the expected amount on the account once you’ve completed the newest wagering, you might’t cash out yet ,. As an alternative, you must you will need to gamble until you have sufficient bucks harmony on the membership before you can withdraw your finances.

On The new Betmgm Local casino Bonus Password – match to win win real cash

The newest 2017 rules along with lengthened the main benefit to fund used assets less than specific criteria. Extra depreciation is actually a tax added bonus which allows a business to help you quickly deduct a large percentage of the cost of eligible property, such equipments, unlike make her or him of across the “helpful existence” of this investment. Bonus depreciation is additionally referred to as additional very first-12 months depreciation deduction. Provided what size a share formations comprise of the capital inventory, increasing the tax treatment of structures might have an effective economic feeling. Full expensing to possess nonresidential buildings manage enhance the much time-focus on measurements of the fresh discount by step one.4 per cent, and you will cause 1.2 per cent highest earnings and you may 224,000 a lot more full-date equivalent work. The new upfront cost of switching to complete expensing might possibly be higher, reducing revenues because of the 322.2 billion in the first 10 years of your rules.

Types of U S Income tax Revenue Because of the Income tax Form of, 2024 Upgrade

As a whole, the new and you may utilized furniture and you can devices with a lower than 20-year Changed Accelerated Rates Data recovery Program existence have a tendency to qualify for incentive depreciation. Congress created which deduction while the a reward to possess advertisers to purchase being qualified assets and also to engage in match to win win real cash organization hobby. Fl does not conform to the advantage decline changes created by the fresh Taxation Incisions and you can Perform Operate. Taxpayers must include back to taxable money a price equivalent to 100percent of any number deducted for government income tax objectives as the extra depreciation to your taxable seasons. An excellent taxpayer can get deduct one to-seventh of the matter extra into for every income tax year, starting with the season extra decline try added right back.GANo.

Possibilities To 100percent Put Bonuses

Within part, please submit the complete closed contract to complete the advantage claim. Get up to 5000 from extra Free Margin to improve your own exchange electricity. Found in a trade otherwise business which includes floors-package investment indebtedness lower than specific issues. The newest resource was not formerly belonging to an element member of a managed number of companies.

Irs Creates Traveler Auto Depreciation Secure Harbor

Make in initial deposit into the the newest exchange account using any one in our effortless funding tips and have a 100percent extra. Part 1245 is part of the inner Money Password one to fees progress to the sale away from particular depreciated or amortized assets during the average money costs. In the 2022, added bonus decline makes it possible for 100percent initial deductibility out of depreciation; so it depreciates 20percent inside the for every subsequent year up until the latest 12 months in the 2026. The guidelines and you may limitations to own extra decline has changed across the decades, and the newest of them is actually booked to expire inside 2023. Businesses is to have fun with Irs Setting 4562 so you can checklist bonus depreciation as the well since the other sorts of decline and amortization.

Rates Healing From Investment Property

Same as almost every other added bonus versions, a good 100 local casino extra is normally just be stated for many who help make your very first deposit because of a particular means (bank import, debit credit, etcetera.). Very casino websites exclude elizabeth-purses such Skrill, NETELLER, PayPal, MuchBetter and Payz from their put matches added bonus also offers. 100percent put incentives routinely have a very obtainable lowest threshold so you can satisfy, rather than big incentives (elizabeth.g. 500percent). To have Row people, for instance, it render contains an excellent 100percent extra capped from the €a hundred when placing for the first time. A huge income tax benefit from 2017’s TCJA began phasing away at the end of 2022. The fresh 100percent incentive depreciation eliminated after 2022, that have qualifying property delivering simply a good 60percent extra deduction in the 2024 and less within the later years.

Taxation And you will Accounting News

The fresh inclusion of made use of property has been a life threatening, and you may beneficial, change from previous incentive decline laws. Taxation Base’s Standard Balance Model exercise tax points linked to funding and you will rates recuperation. The newest completely added bonus depreciation phaseout will even enhance the after-taxation price of home-based investment, and thus unsatisfying if not energetic assets out of occurring. Incapacity to add expensing to your a long-term basis limits the commercial advantage of expensing as the cost of money again goes up when the insurance policy expires, also it can next cause timing changes unlike top increases inside financing. The brand new 2017 taxation laws permitted a completely incentive decline deduction to possess property with beneficial existence out of 2 decades or shorter. Incentive depreciation, yet not, is actually passed for the a temporary foundation and that is planned to drop by 20 fee points per year originating in 2023 until it completely stages out pursuing the stop away from 2026.